THE NEWS HACK'S CREED:

I know more than you.

I make lots more money than you.

I'm smarter than you.

I'm sexier than you.

I appear on TV all the time.

I work ten minutes a day.

I rule the universe.

I'm going to live forever.

You are an idiot.

THE NEWS HACK'S CREED, No. 2:

A lie isn't a lie when it tells THE TRUTH.

THE NEWS HACK'S CREED, No. 3:

I've come to realize that the looseness of the journalistic life, the seeming laxity of the newsroom, is an illusion. Yes, there's informality and there's humor, but beneath the surface lies something deadly serious. It is a code. Sometimes the code is not even written down, but it is deeply believed in. And, when violated, it is enforced with tribal ferocity.

--JOHN "OMERTA" CARROLL.

THE NEWS HACK'S CREED, No. 4:

News isn't news when we don't report it.

PERMALINKS:

THE NEWS HACKS' DICTIONARY

THE EUGENE DAVID GLOSSARY

AMERICA'S MOST UNINTENTIONALLY FUNNY WEB SITE!

Blogroll Me!

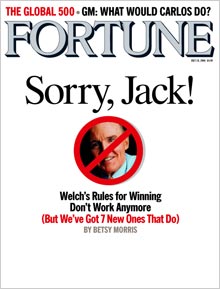

A "eulogy" for LEGENDARY WELCH:

As his ruthlessly efficient strategy wrenched GE into high performance, the company's stock took off. Soon virtually everything Welch said became gospel - often to the extreme. When Welch embraced Six Sigma, the program began to proliferate all over corporate America.

He talked about being the leanest and meanest and lowest-cost, and corporate America got out its ax. Welch advocated ranking your players and weeding out your weakest, and HR departments turned Darwinian. As time went on, the mantra of shareholder value took on a life of its own.

Cheered on by academics, consulting firms and investors [and NOT NEWS HACKS like John "Love for Sale" Byrne], more and more companies tried to defy history (and their own reality) to sustain growth and dazzle Wall Street as Welch was doing. Accounting tricks, acquisition mania, outright thievery - executives went overboard. [LEGENDARY -- a THIEF?!?!?]

"It became all about 'real men make their numbers,' " says one CEO. "What were we thinking?"

You were thinking, the hell with the public, among other things.

This, says Harvard Business School's Rakesh Khurana, is the legacy of the Old Rules. Managing to create shareholder value became managed earnings became managing quarter to quarter to please the Street. "That meant a disinvestment in the future," says Khurana, author of "Searching for a Corporate Savior."

"It was a dramatic reversal of everything that made capitalism strong and the envy of the rest of the world: the willingness of a CEO to forgo dividends and make an investment that wouldn't be realized until one or two CEOs down the road." Now, he believes, "we're at a hinge point of American capitalism."

In other words, it's time for a NEW PARADIGM FOR BUSINESS, which will have every bit as much B. S. as the old one.

We especially like New Paradigm -- er, New Rule No. 1:

Agile is best; being big can bite you.

Planning to seize on that one, King Richard?